Ridgerunner:

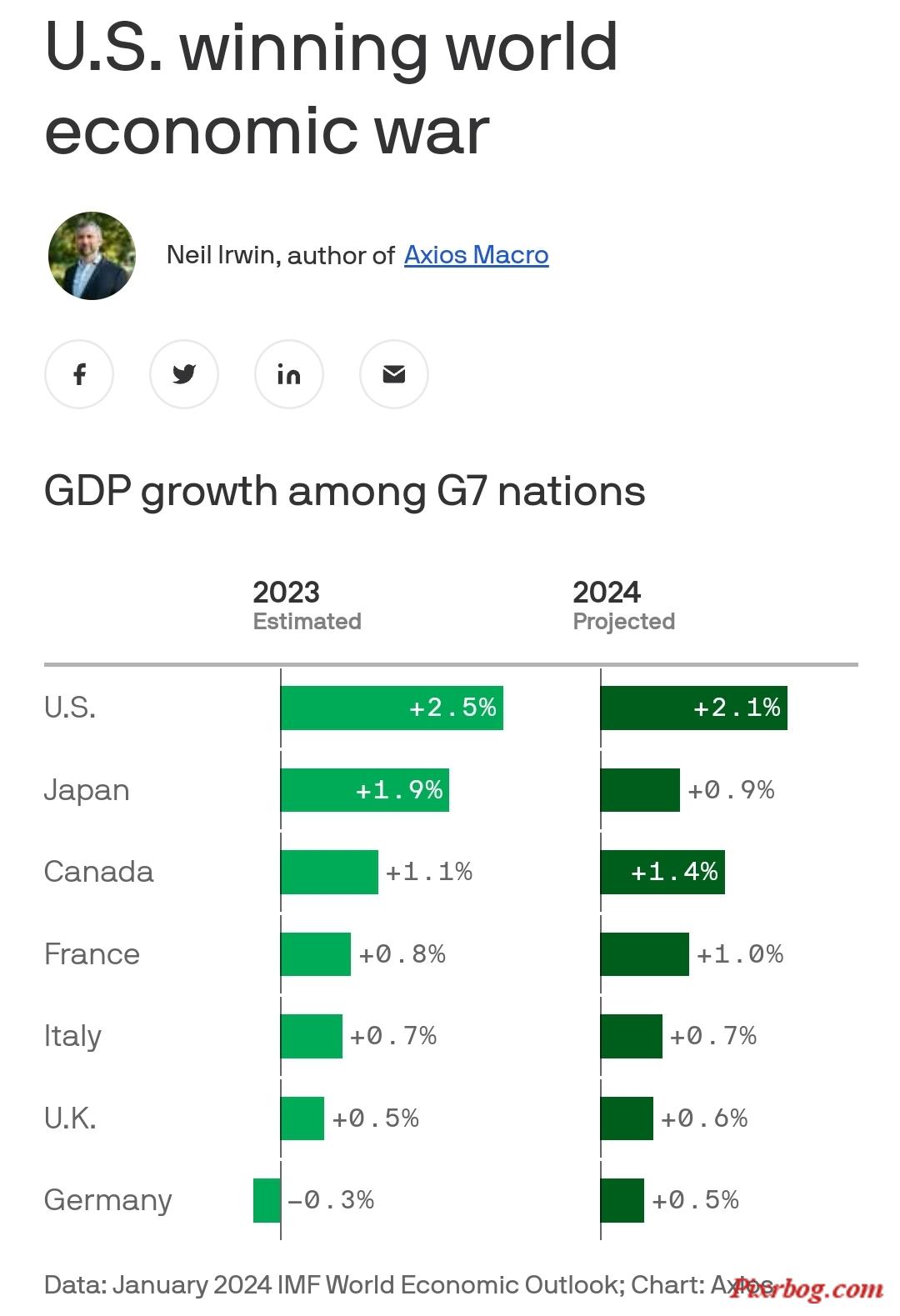

GDP rates can also expose inflation.

Fleedle:

Hopefully. Estimates and projections.

UncleJesse:

We did it Joe.

Fleedle:

— Americans reached a new record for credit card debt, at more than $1 trillion, an indication people are using debt to finance basic needs

— This is further supported by the collapsing savings rate. The PSR collapsed from a high of ~25 percent in April 2021 to ~4 percent in October 2023.

— GDP data show that were it not for govt deficit spending, we'd already be in a recession. (And as deficit spending exacerbates the inflation crisis, Americans are paying dearly so Biden can falsely claim the economy isn’t terrible)

— Full-time jobs are being replaced with multiple part-time jobs. In December alone more than 1.5 million full-time jobs were lost & the number of multiple job holders soared to new record

— Mortgage rates hit the highest levels in 40 years; median home prices are now “unaffordable” in 99 percent of U.S. counties; foreclosure rates were up almost 200 percent since 2001

— Car loan debt highest in history; interest rates highest since 2001: delinquency rates at the highest level in 30 years

Fleedle:

— The Conference Board's index of leading economic indicators has declined 21 months in a row, the longest such streak since the "Great Recession" of 2008

— The Social Security system is already in arrears. To keep paying out benefits, it will need to start cashing in its intra-govt IOUs, meaning the feds need to sell more Treasurys. As interest on the debt has been growing exponentially since 2001 (increasing more than 100 percent from $450 billion to more than $1 trillion), debt servicing has become the biggest annual expenditure in Washington, more than even the Pentagon budget. These numbers are only going to continue exploding as Social Security is officially broke.

— The only way the feds can continue servicing the debt is through more money printing, which means adding more fuel to the inflation inferno, aka the worst possible thing for an economy teetering on the precipice.

— The yield curve has been inverted for 13 months, which is usually recognized as the best indicator of an impending recession. The NY Fed's recession probability model projects a 90 percent chance of a recession in the next 12 months. (But, again, if you factor out the govt's deficit spending, we've already been in a recession for awhile now.)

You must be logged in to leave comments.